Tariffs weigh on mom-and-pop stores as small business profit growth turns negative for first time in 18 months, BofA says

For the first time in a year and a half, the growth engine of the U.S. small business economy collapsed, with profitability growth falling into negative territory in November. Rising costs associated with tariffs and inflation are forcing Main Street merchants to raise prices at historic rates, even as the holiday shopping season offers a critical lifeline, according to the December edition of the Bank of America Institute’s Small Business Checkpoint.

Even if the bank accounts of small businesses remain generally in deficit, the trajectory is worrying. Year-on-year profitability growth fell below zero (-0.02%) last month, marking the first negative reading for this indicator in 18 months. BofA sees two real reasons why this is likely rate-related, with the net percentage of owners increasing average sales prices jumping 13 points from October to 34% net, the highest figure since March 2023 and the largest monthly increase in the history of the National Federation of Independent Business’ definitive small business survey.

This is also evident in the growth in small business profitability by sector, tracked in BofA Small Business Accounts data, where wholesale trade declined the most over the year, down 1% in November. In wholesale, durable goods such as electronics and furniture subject to tariffs accounted for most of the decline in the second half, although non-durable goods like clothing are also down so far this quarter. This contraction indicates that even as revenue continues to come in, the cost of doing business is eating into margins faster than sales can compensate. The data suggests that for many landlords, absorbing the costs of rates is no longer an option; they have to charge more to survive.

Vacation hopes and hiring freeze

Despite the drop in profitability, total profits remained positive in November, supported by the holiday calendar. Small Business Saturday, which falls on November 29, has become a crucial event, with owners estimating that the day generates 20% of their annual sales. However, the BofA report notes that consumer momentum appeared to falter over the Black Friday weekend, suggesting that holiday spending may not be the panacea retailers were hoping for.

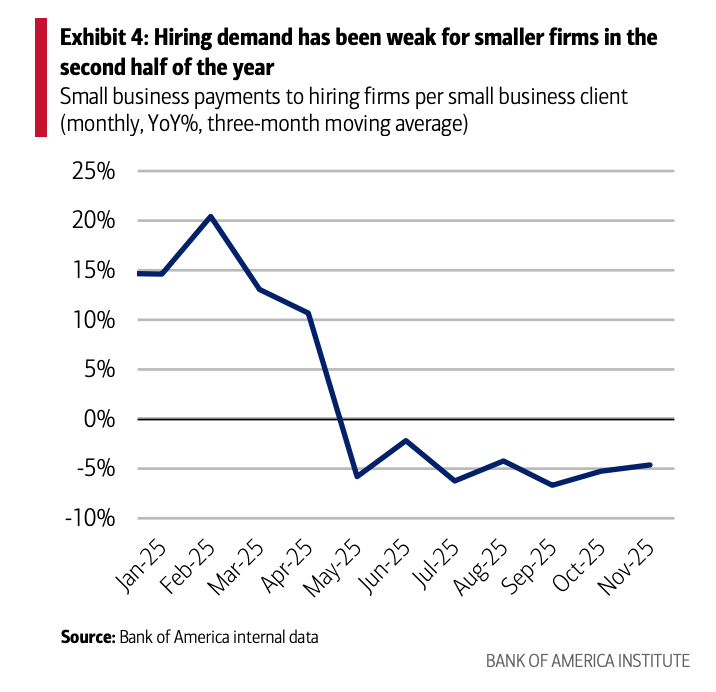

Economic pressure is also cooling the job market. Payments to hiring businesses fell 4.6% year-over-year, confirming a weaker job market for small businesses. BofA noted support for the thesis of collapsing small business hiring from other research, namely the Institute’s November jobs report and data from payroll provider ADP, both of which found a decline driven by losses at small businesses. “With nearly half of the U.S. workforce employed by such companies, this underscores the importance of the small business foundation.”

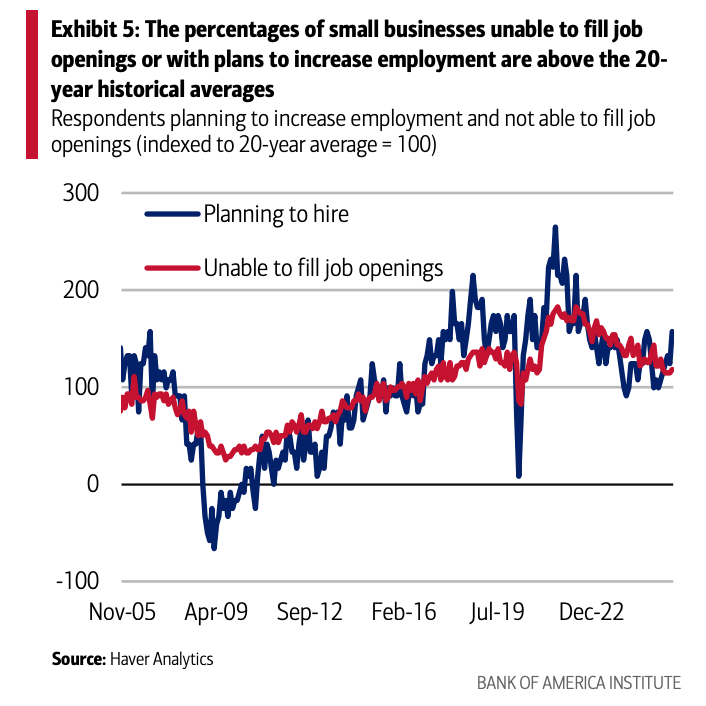

However, the labor situation remains nuanced. While overall hiring has slowed, industries facing chronic labor shortages, like construction and restaurants, have actually increased payroll growth as they rush to fill vacant positions. Still, BofA notes that small businesses generally plan to increase employment and are unable to fill job openings at rates higher than the average over the past two decades. Talk to FortuneMoody’s Eva Roytburg Earlier this week, regarding the revelation of disappointing economy-wide employment data, Moody’s chief economist Mark Zandi said “there’s just no progress” with the labor market “stuck in the mud.”

Looking towards 2026

Despite the current contraction in profits, the business climate is not entirely gloomy. Optimism about the year ahead is on the rise and hiring plans for the next three months are actually at their highest level of the year.

Longer term, owners are banking on technology to restore efficiency. According to Bank of America’s 2025 Business Owners Report, 50% plan to implement artificial intelligence (AI) in the next five years. Spending on technology services, including AI, increased 6.2% in November, indicating that companies are investing in digital transformation to adapt to a costly environment.

However, for now, the small business sector finds itself in a precarious position, like a ship taking on water as it moves forward. The benefits are there, but the impact of tariffs and inflation is heavier than it has been in almost two years.