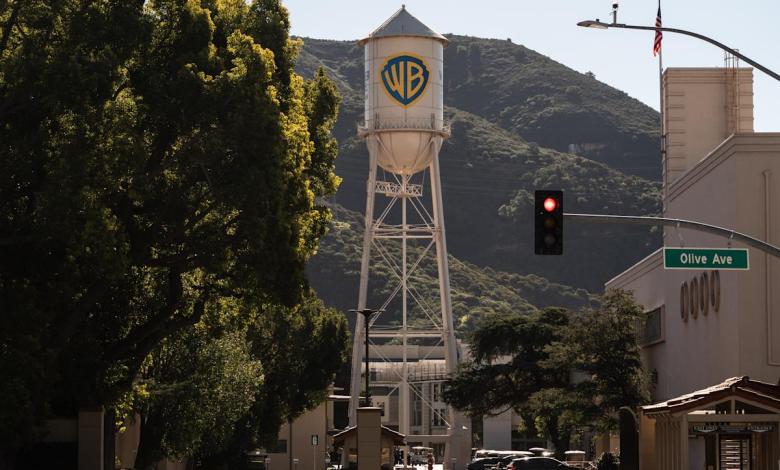

What you need to know about Paramount’s hostile bid for Warner Bros. Discovery

NEW YORK — Warner Bros.’ friendly deal Discovery aiming to sell itself to Netflix was just upset by a hostile actor, Paramount, which made a higher offer to Warner shareholders and sparked what is likely to be a long fight in the media industry’s latest bout of consolidation.

The offer comes after Warner agreed last week to be acquired by Netflix for $72 billion.

Competing offerings are paving the way for combining some of the most beloved entertainment properties. Netflix’s vast library includes “Stranger Things” and “Squid Game,” while the much smaller Paramount owns its Hollywood studio and major TV networks like CBS and MTV. Both covet Warner, owner of Warner Bros. Pictures, HBO and the Harry Potter franchise.

“Which media company, if any, ultimately secures (Warner), controls the calculus of the streaming wars and much more,” said Mike Proulx, vice president and research director at research firm Forrester.

Both deals will be subject to regulatory review, an issue that President Donald Trump has already weighed in on.

Here’s what you need to know about the three actors and what the deals mean for the entertainment industry.

An overview of the offers

CEO David Zaslav seeks deals for Warner Bros. Discovery from at least Octoberwhen he said the company might be willing to sell all or part of its business.

Paramount said Monday it submitted six proposals to Warner over a 12-week period before its offer was rejected in favor of Netflix.

So Paramount decided to go directly to Warner shareholders with an offer it says is worth about $79.9 billion, or $30 per share in cash. Paramount, unlike Netflix, is also offering to buy Warner’s cable assets and is asking the company’s shareholders to reject Netflix’s offer.

Paramount CEO Larry Ellison said the offer was worth about $18 billion more in cash than Netflix’s competing cash and stock offer.

The deal with Paramount includes help from investors such as Trump’s son-in-law Jared Kushner and funds controlled by the governments of Saudi Arabia and Qatar, according to a regulatory filing.

Netflix is offering a combination of cash and stock valued at $27.75 per Warner share. His offer values Warner at $72 billion, excluding debt, but he is not bidding on Warner-owned networks such as CNN and Discovery.

Prior to Paramount’s offer, the Netflix deal was expected to be finalized within the next 12 to 18 months, after Warner completed the previously announced separation of its cable businesses.

Warner must tell shareholders whether Paramount’s offer constitutes a superior offer by Monday, December 22. If Warner decides that Paramount’s offer is superior, Netflix would have the opportunity to match or beat it.